3 Reasons To Know Your Break-Even Point

I will never forget the day I became general manager of a Domino’s Pizza restaurant. I was very excited for this growth opportunity, going from a pizza delivery girl to a store manager, but I soon discovered the size of the challenge: the unit that was under my responsibility from that day forward, was losing money.

My district manager had faith on me, he knew that I had all the knowledge, the skills, and the ability to turn this business around. So, he taught me all about the break-even point. Because of this, within 30 days, not only did we get to break-even, but we actually got a little bit of a profit.

The history repeats itself with many of my clients. That’s why I consider that the break-even point is the most important number in your business. If you are aware of it, you can learn a lot about your units, whether it’s one or multiple, and implement the right strategies to make the most out of your business.

Do you want to learn how to calculate the break-event point of your business? In my book, The Franchise Fix, there’s a specific chapter dedicated to the numbers, where you can learn how to do it and get the necessary management systems to control your profits. Go to www.TheFranchiseFix.com to order it and get a special discount for a limited time! Use Code: TFF50 - Or you can also find it on Amazon or your local book stores like Barnes & Noble.

Having this critical indicator can also help you with three key aspects of your entrepreneurial adventure: knowing if your business is profitable, if you are meeting your financial goals, and what you need to improve to achieve your financial and time freedom.

1. Know if your business is viable

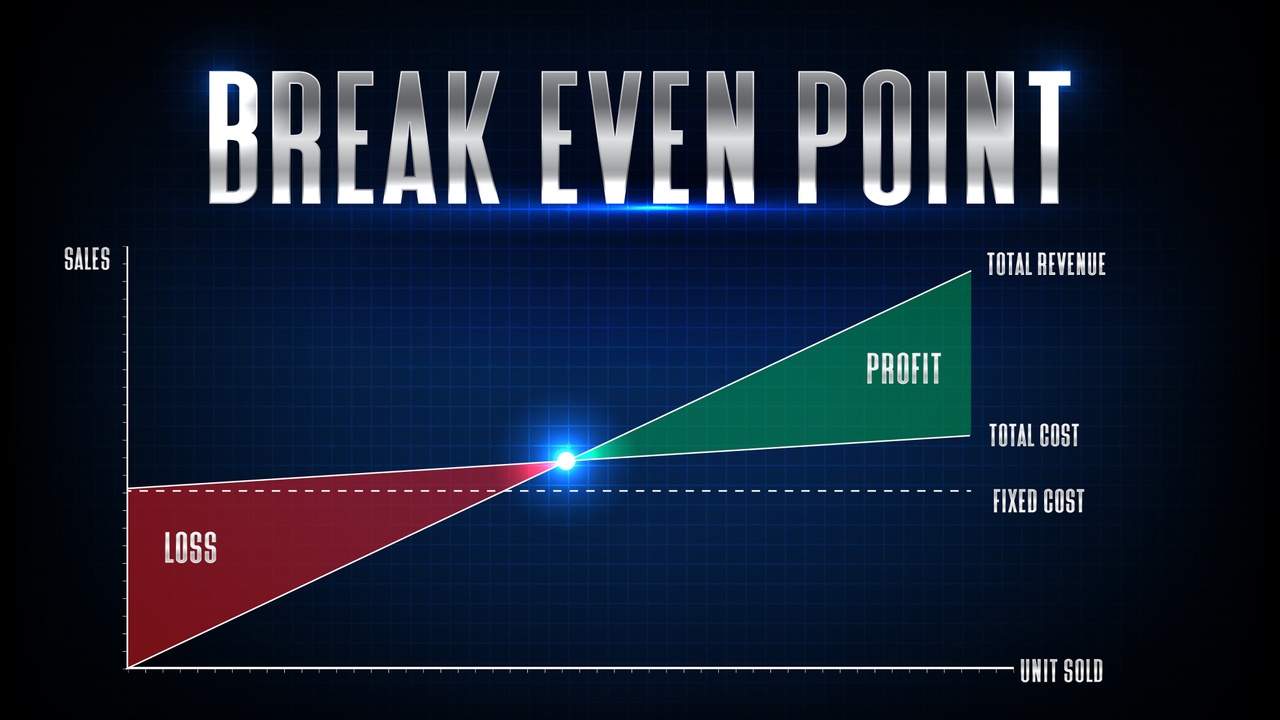

When you calculate your break-even point, you will know exactly how many sales you need to have in that location to make profits. Because getting to break-even means that you have covered all your fixed and variable costs, and you can start counting earnings. But first, you need to know if that business can get to that break-even point, and beyond.

Perhaps you’ve heard some business owners say that they start making money on a certain day of the week, for example, by Thursday evening, or on Saturday morning. That's because they know that, when they reach this window of time, they begin to exceed the sales they need to break-even.

Another important financial knowledge that you should have is that not every dollar that comes in beyond that break-even point is profit. You must remember that even though you already paid for your fixed costs –like rent, electricity, and insurance– with the previous sales, you still have to pay for your variable cost –like labor cost, product cost, royalties, or the franchise marketing fee–.

That’s why it’s so relevant to be clear on how many sales your business needs to do break-even and cover all your costs. Once you know that, you’ll figure out if your business is viable.

One more thing: if you are a growing franchisee before you commit to any location and lease, you need to calculate the break-even point to find out if the move is smart.

2. Determine your financial goals

Whether you operate a franchise, own a multi-unit enterprise, or run an independent business, I’m sure that you are looking to have financial freedom. But you have to determine how much profit you want to make out of your business to accomplish that.

This will help you analyze the performance that your business should have. For example, if you establish a goal of 4,000 dollars of profit a month, how much do you need to sell in 30 days to cover your fixed costs, the variable ones, and be able to earn that amount?

Based on my +30 years of experience I can say that almost every top-performing franchisee that is growing into 10, 50, or 100 units, knows their break-even and has specific sales targets, driven by the profit they want to have in each of their units. If this strategy works for them, it’ll do wonders for you.

3. Discover what you need to improve

If you are not meeting your profit goals, you need to go back to your break-even calculation and find out what numbers are not meeting your expectations. Then, you must take the necessary actions to turn them around.

Here’s a clue: the three most important numbers in your business, which I call your Business Trinity, have to have great performance. Don’t know what are they? You can discover them in this video.

This financial analysis will also reveal the costs or expenses that are causing your unit not to make the profit that you thought it was going to make. And so, it will help you focus on the areas that need improvement to positively impact your overall business and operations.

If your business is not at its best, I’m sure you are capable to make things better, just as I did back in my manager’s days, and my clients have done with our help. You are not alone; the American Franchise Academy is here to help you fulfill your financial and entrepreneurial dreams! We have educational programs that teach franchisees and business owners the tips and tricks they need to achieve success. You can review them at this link.

Also, I invite you to subscribe to our YouTube Channel to view our weekly Multi-Unit Mastery Monday live videos where I share advice and solve any questions you may have about how to improve your business.

Reflections:

- Do you know how to calculate your break-even point?

- Do you know how much is the minimum you have to sell each day or month?

- Are you clear about the profit goal you want to achieve?

- Have you earned what you expected? What can you do to change those numbers?